In order to ensure maximum consistency with existing EU scenarios and projections various input parameters of the renewable scenarios conducted with Green-X and HiREPS are derived from PRIMES modelling, specifically concerning the Integrated Assessment and the data used therein for EU countries. More precisely, the PRIMES scenario used is the PRIMES reference scenario as of 2013 (EC, 2013b). The main data source for RES-specific parameters is the Green-X database - this concerns for example information on the status quo of RES deploy-ment, future RES potentials and related costs as well as other country-specific parameter concerning non-economic barriers that limit an accelerated uptake of RES. Moreover, the policy framework for RES is specifically defined for this assessment. Energy demand developments for Turkey, Western Balkans and North Africa as well as assumptions on the conventional supply portfolio and on related reference conversion efficiencies and carbon intensities have been derived within this project as part of the bottom-up case study works by region while for EU countries the PRIMES reference scenario serves as basis.

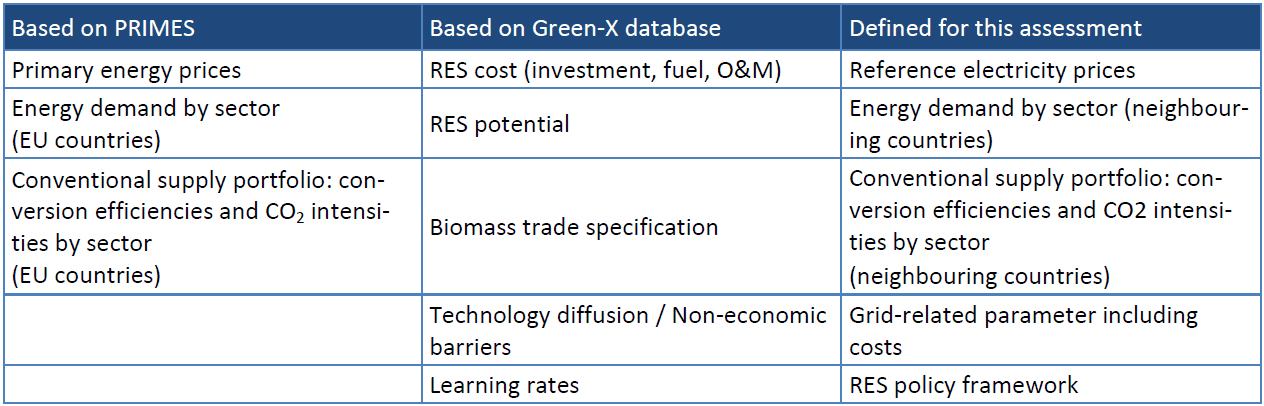

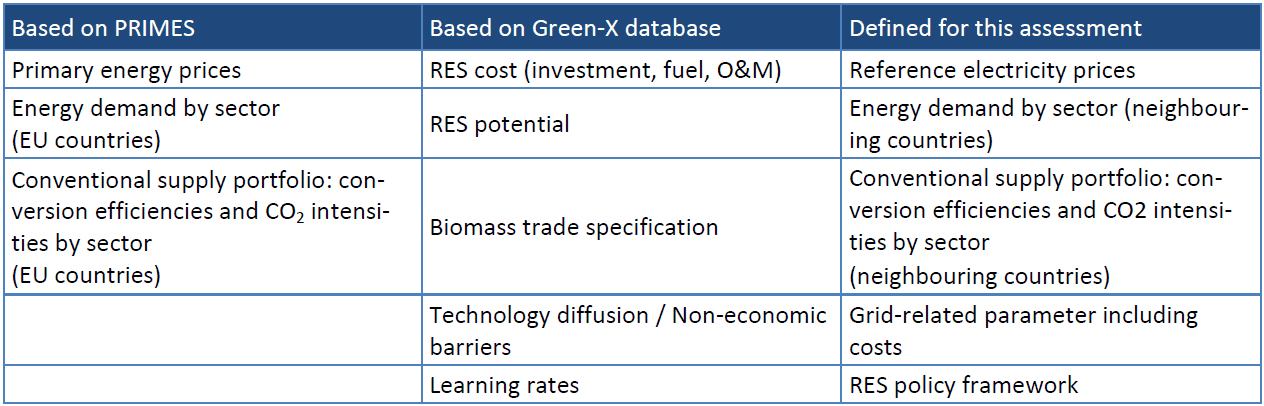

Table 2-1 provides a concise overview on which parameters are based on PRIMES, on the Green-X database and which have been defined for this assessment.

Table 2-1: Main input sources for scenario parameters in the integrated assessment of the BETTER project

Below we discuss general parameter like energy demand or energy prices in further detail whereas specific input parameter for the techno-economic policy assessment done with Green-X or for the (technical) power-systems analysis undertaken by use of HiREPS as well as details on the Green-X database on potentials and costs can be found in the corresponding scenario reports.

Energy demand:

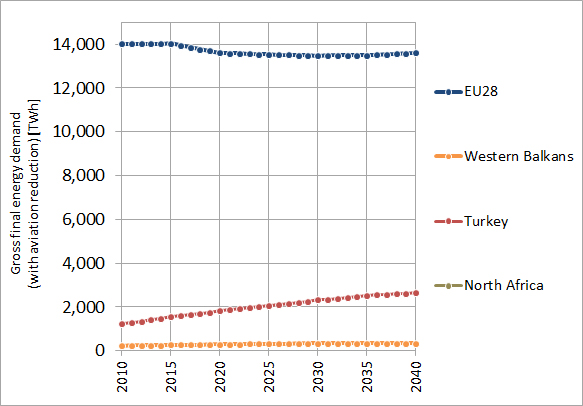

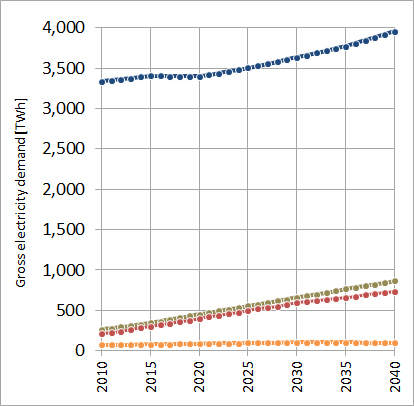

Figure 2-1 depicts the projected energy demand development at EU 28 level according to the PRIMES reference scenario and for each assessed neighbouring region / country in accordance with the bottom-up assessment done by case study (cf. Trieb (2015) for North Africa, Tuerk et al. (2015) for Western Balkans and Ortner et al. (2015) for Turkey. More precisely, Figure 2-1 shows the assumed future development of gross final energy demand (left) and of gross electricity demand (right).

Figure 2-1: Comparison of projected energy demand development at EU28 level and by neighbouring country/region – gross electricity demand (left) and gross final energy demand (right). Source: PRIMES reference scenario (EC, 2013) and own BETTER assessments

Fossil fuel and carbon prices:

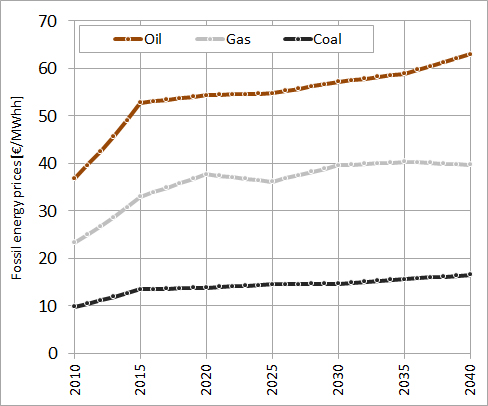

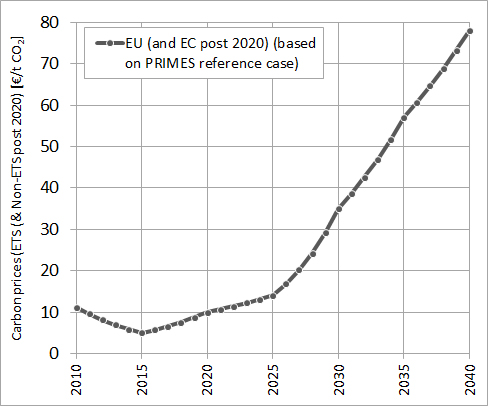

The country- and sector-specific reference energy prices used in this analysis are based on the primary energy price assumptions applied in the latest PRIMES reference scenario that has also served as a basis for the Impact Assessment accompanying the Communication from the European Commission “A policy framework for climate and energy in the period from 2020 to 2030” (COM(2014) 15 final). As shown in Figure 2-2 (left) generally only one price trend is considered - i.e. a default case of moderate energy prices that reflects the price trends of the PRIMES reference case. The CO2 price underlying in the scenarios presented in this report is also based on recent PRIMES modelling, see Figure 2-2 (right). In modelling it is assumed that CO2 pricing affects conventional supply in the EU28, and post 2020 also in Contracting Parties of the Energy Community (currently limited Western Balkans but in future probably including Turkey). Thus, in the model, it is assumed that CO2 prices are directly passed through to electricity prices as well as to prices for grid-connected heat supply.

Figure 2-2: Assumptions on prices for fossil fuels (left) and CO2 emissions (right). Source: PRIMES scenarios (EC, 2013)

| <<Back | >>Back to Introduction<< |